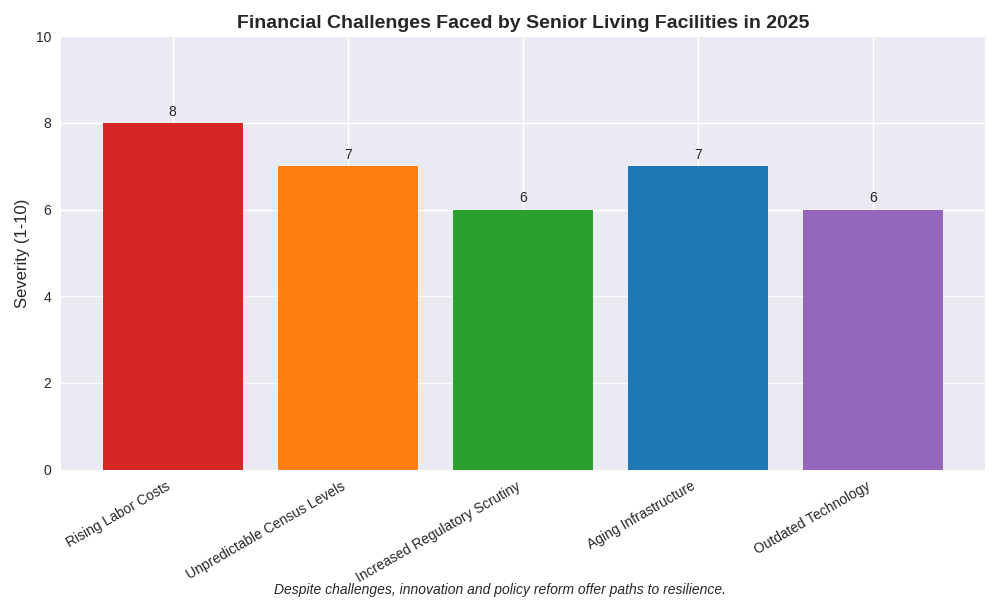

In 2025, senior living communities are grappling with mounting operational costs while caring for an aging population with increasingly complex needs. Staffing remains a major challenge: wages are rising, agency fees are still high, and the workforce has yet to fully recover from pandemic-related attrition. At the same time, more individuals are opting for home-based care, making census levels harder to predict and revenue less stable.

Beyond labor and occupancy, facilities are facing stricter regulations, aging buildings, and escalating capital expenses—all while relying on outdated or fragmented technology systems. In this climate, having clear financial visibility is critical. Organizations that shift away from rigid models and embrace flexible, data-driven strategies are better equipped to adapt. Tools like scenario planning, cost analysis, and service line profitability reviews can help stabilize operations and support long-term sustainability.

Compliance requirements continue to grow, with more frequent audits and increasing complexity in Medicare and Medicaid billing. Uncertainty around future funding and reimbursement reforms adds volatility to revenue streams. Reviewing internal controls and assessing exposure to financial risk can help providers prepare for regulatory changes. Scenario planning is a valuable tool for anticipating shifts in funding and adjusting operations proactively.

Meanwhile, many senior living facilities are dealing with aging infrastructure that demands significant capital investment. Rising construction costs and higher interest rates make financing more difficult. Prioritizing capital projects, optimizing reserve funds, and reassessing debt structures are key to effective long-term financial planning. Aligning funding strategies with operational needs helps build resilience in the face of these challenges.

Many providers still rely on outdated, siloed systems that limit access to real-time data, increase the risk of errors, and reduce operational efficiency. Implementing dashboards and automating reporting can enhance compliance tracking, workforce management, and financial oversight.

Automation tools—such as electronic health records, automated billing, and workflow software—help reduce administrative burdens and labor dependency. A clear understanding of costs and integration points supports smoother technology rollouts. AAFCPAs recommends selecting systems that improve operations while keeping care quality front and center. Expanding or better integrating existing technologies may offer quick wins for teams.

As financial and operational demands grow, AAFCPAs delivers strategic solutions tailored to budgeting, reimbursement analysis, cash flow optimization, capital planning, and internal controls—helping organizations stay focused on care while adapting to change.

We also assist with system evaluations, vendor selection, and ERP implementations, emphasizing efficiency, integration, and long-term value. For providers using outdated or fragmented systems, we help define requirements, coordinate vendor demos, and support implementation and change management. Our team builds dashboards, develops Key Performance Indicators (KPIs), and enhances data analytics through automation to support smarter decision-making. We also automate manual processes like employee status updates, reporting, and document management to boost operational efficiency.

Additionally, we offer outsourced accounting, fractional CFO services, technical accounting support, and regulatory readiness. With deep expertise in healthcare finance, AAFCPAs helps senior living organizations navigate complex regulations and evolving reimbursement models to maintain financial health in an uncertain environment.

Insights contributed by Robert Constantino, CPA, MSA, Director, and Courtney McFarland, CPA, MSA, 340B Apexus Certified Expert™.

Have questions? Reach out directly to our authors or your AAFCPAs advisor.

Subscribe to AAFCPAs for more insights and updates tailored to the healthcare industry.